HIGHLY ENCOURAGING INITIAL VISUAL RESULTS, INCLUDING VISIBLE GOLD

FOR IMMEDIATE RELEASE…Vancouver, BC – October 16, 2023 – Gelum Resources Ltd., (the "Company" or "Gelum", CSE: GMR, OTCQB: GMRCF), through its recently announced option agreement with Wealth Minerals Ltd. (“Wealth”, or the “Optionee”, CSE: WML), is completing an approximately 1300-metre drill programme on the Eldorado Gold Property. Wealth mobilized both skid-mounted and helicopter-portable drill rigs to the Eldorado Gold property in late September to resume exploring high-grade gold mineralization. The property was last drilled in September 2022 (see news release dated November 1, 2022). In addition, Dias Geophysical of Saskatchewan is completing a 3D pole-dipole DCIP survey over approximately 1.5 square kilometres of the main mineralized trend.

The Eldorado Gold Property is located 22 kilometres north of the Bralorne mine, and 17 kilometres north of the community of Gold Bridge in the south Cariboo (Map 1). The 9028-hectare property covers multiple Minfile listings and two past-producing (1930s & 40s), small-scale gold mines that form the northern extent of the Bridge River-Bralorne/Pioneer orogenic gold system. Gold occurs in polymetallic sulphide veins and vein-stockworks within broad quartz-carbonate alteration in the Eldorado granodiorite stock and surrounding rocks. These units are complexly juxtaposed by numerous faults associated with regional-scale structures linked to gold mineralization. For detailed maps and project photos, please view and download our presentation on our website.

Encouraging Visual Results

To date, five holes have been completed and the sixth is underway (Map 1). The first two holes, ELD23-01 (182m) and ELD23-02 (263m), were drilled in opposite directions from the same drill pad and targeted additional northeast-dipping, sulphide-bearing, siliceous ankerite vein/breccia panels structurally below the approximately 40-metre thick panel intersected last year in hole ELD22-03 (see news release dated March 6, 2023). The extension of this horizon is interpreted to crop out at the south end as gossanous ankerite alteration with anomalous gold on the ridge col east of Nea Peak, over 800 metres south of ELD22-03, for a total potential strike length of 1300 metres. Both holes collared in the main panel of ankerite-silica-sulphide and intersected several additional mineralized vein breccias across their lengths.

Map 1: Location and geology of the recent drill holes, with historical holes for context.

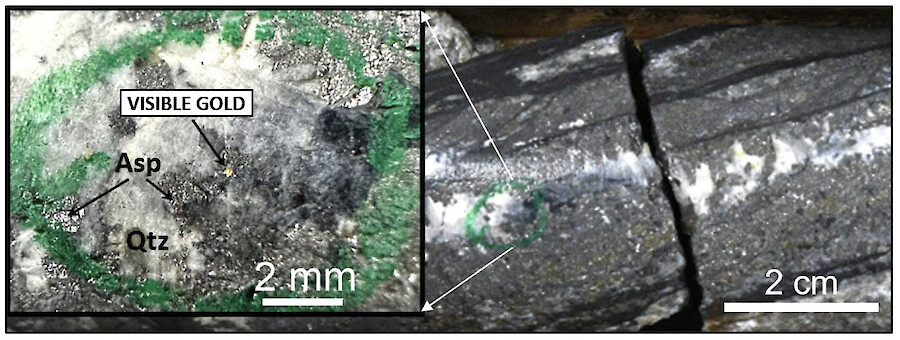

The third drill hole, ELD23-03, targeted the north end of a highly gossanous, gold-mineralized feldspar-porphyry dike on the Robson claim, which lies at the centre of historical ground sluicing and the gold-in-talus anomaly and may be a source of the mineralization in the northeast-dipping panels. At approximately six (6) metres depth, the hole intersected a 4-centimetre vein of massive arsenopyrite-stibnite-galena with visible gold grains (both on outer core and on cut surface; see Photo 1).

Photo 1: ELD23-03 at 6.1m: arsenopyrite-quartz vein with visible gold.

The vein is hosted within a broad zone of iron carbonate alteration with numerous semi-continuous sulphide-rich breccia and vein breccia structures, with the strongest mineralization from approximately 86 – 205 metres down hole (Photo 2). The hole was ended at 258 metres.

Photo 2: ELD23-03 between 104.5 – 116.5m, showing typical sulphide-silica breccia.

The fourth drill hole, ELD23-04 (188m), targeted the western extension of the east-west trending, shallowly north-dipping Robson vein (with minor historical gold production) and the subparallel, and higher grade, Robson shear. The Robson vein and shear zone were last drilled in 1986 with five short holes. Hole CR86-3 intersected 0.8 metres of 37.4 g/t gold and 388 g/t silver at 7.6 metres down-hole. Channel sampling of the trench in 2006 by one of the property owners returned 1.0 metre of 48.7 g/t gold and >200 g/t silver. A weak VTEM anomaly 400 metres west of the historical workings was Maxwell modeled and the conductor plate closely matched the Robson vein orientation.

ELD23-04 was collared to intersect the centre of the modeled VTEM conductor, 400 metres west and along strike of the vein in the Robson trench. The hole intersected a polymetallic sulphide-quartz vein mineralogically identical to the Robson shear zone, with 9 cm true width at 82.7 metres down hole (Photo 3). The current drill hole, ELD23-06, is collared northwest and below this hole to intersect the vein approximately 150m down-dip.

Readers are cautioned that historical drilling and surface sampling results reported here should be viewed primarily as a guidance for future exploration drilling. Surface sampling is prone to sampling bias and is not necessarily a reliable indicator of mineralization at depth. The qualified person for this release has not done sufficient work to independently verify the historical sampling results described above.

Photo 3: ELD23-04 at 82.7m: stibnite-galena-sphalerite-arsenopyrite vein with quartz envelope.

Hand-held XRF analyses of this vein, using a SciAps X-505 Mining Analyzer, indicates highly elevated silver, antimony, lead and zinc, in levels matching the Robson shear vein. This vein is therefore expected to also have a significant gold grade.

The fifth hole, ELD23-05 (239m), targeted a series of moderately southeast to northeast-dipping arsenopyrite-silver veins in silicified siltstone/sandstone exposed in a newly discovered outcrop below the main logging road, along Hughes Creek. The new showing is below the Robson showing and on strike with the regional north-northwest mineralized trend (see Map 2). At least three arsenopyrite veins from 1 to 10 cm thick are exposed for several metres along strike. Hand-held XRF analysis indicates they have silver content in the 100 to 700 ppm range, which is similar to gold-bearing veins elsewhere on the property. The geochemical database indicates that gold correlates most closely with silver than all the other most common metals/metalloids (i.e., arsenic, antimony, lead, zinc, copper).

All mineralized intervals in the drill core are currently being cut and sampled with samples to be shipped for assay to MSA Labs in Langley, B.C..

Readers should note that geochemical results from a hand-held XRF analyzer are given herein only for exploration guidance and to determine mineralogy and relative metal content; the analysis significance is limited by the narrow (1cm) sampling window, inhomogeneity of mineralization, and limited depth penetration. All XRF results are subject to confirmation by chemical analysis from an independent laboratory when the samples are submitted.

References to other nearby mines and deposits made in this news release provide context for the Eldorado Project, which occurs in a similar geologic setting, but this is not necessarily indicative that the property hosts similar grades and tonnages of mineralization.

3D IP Survey Near Completion

Dias Geophysical Ltd. of Saskatchewan is about three-quarters through completing a 3D pole-dipole DCIP survey over approximately 1.5 square kilometres. The 3D IP survey underway will provide continuous 3D coverage across this area, both below and adjacent to the drilling, to support a robust 3D inversion model with a near-surface resolution of approximately 12.5 by 25 metres and a depth search of approximately 400 metres. Preliminary data covering about half the area shows that low resistivity and high chargeability are present at depth in the western portion of the survey area and become shallower towards the west, approaching the main ridge. Under the main ridge, close to the center of the survey area, both low resistivity and high chargeability are closest to the surface.

Qualified Person

John Drobe, P.Geo., a qualified person as defined by NI 43-101, has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Drobe is not independent of the Company as he is a consultant of the Company.

About Gelum Resources Ltd.

Gelum Resources is a Company led by seasoned management and advisors in the mining and financial sectors. The Company’s objective is to define a multi-million-ounce economic gold deposit on the 9028-hectare Eldorado Gold Project, located within the Bralorne-Bridge River gold district, only 190 kilometres north of Vancouver and 74 km northwest of the town of Lillooet, B.C. The Bralorne mines historically exploited the largest, highest-grade, longest-producing lode-gold deposit in B.C. Management is proud to have developed an excellent working relationship with the Bridge River Indian Band (Xwísten) the project is within the traditional territory within the St’at’imc territory (Traditional Territory) in which Xwísten and its members assert, hold and exercise constitutionally protected Aboriginal Title and Rights (“Indigenous Title and Rights”).

For further information about the Company and its exploration portfolio, please refer to Gelum Resources latest Corporate Presentation.

Follow Gelum Resources online in the links below for additional updates:

On Behalf of the Board of Directors

Hendrik van Alphen, Director

For further information about Gelum, please contact:

Hendrik van Alphen (henk@hvana.com) or Marla Ritchie (marla@gelumresources.com)

Phone: 604 484-1228

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE- Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information:

This presentation contains forward-looking statements and forward-looking information (collectively, “forward- looking statements”) within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding any potential increase in shareholder value through the acquisition of undervalued precious metal deposits for development, joint venture or later disposition, the potential to partner with mine developers to achieve production at any of the Company’s properties (existing or future); the potential for the capital costs associated with any of the Company’s existing or future properties to be low; the potential for the Company to outline resources at any of its existing or future properties, or to be able to increase any such resources in the future; concerning the economic outlook for the mining industry and the Company’s expectations regarding metal prices and production and the appropriate time to acquire precious metal projects, the liquidity and capital resources and planned expenditures by the Company, the anticipated content, commencement, timing and cost of exploration programs, anticipated exploration program results and the anticipated business plans and timing of future activities of the Company, are forward looking statements. Forward-looking statements are based on a number of assumptions which may prove incorrect, including, but not limited to, assumptions about the level and volatility of the price of gold; the timing of the receipt of regulatory and governmental approvals; permits and authorizations necessary to implement and carry on the Company’s planned exploration programs at its properties; future economic and market conditions; the Company’s ability to attract and retain key staff; and the ongoing relations of the Company with its underlying lessors, local communities and applicable regulatory agencies.

Accordingly, the Company cautions that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ, and such differences may be material, from those set out in the forward-looking statements as a result of, among other factors, variations in the nature, quality and quantity of any mineral deposits that may be located, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, material adverse changes in economic and market conditions, changes in the regulatory environment and other government actions, fluctuations in commodity prices and exchange rates, the inability of the Company to raise the necessary capital for its ongoing operations, and business and operational risks normal in the mineral exploration, development and mining industries, as well as the risks and uncertainties disclosed in the Company’s most recent management discussion and analysis filed with various provincial securities commissions in Canada, available at www.sedar.com. The Company undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events except as required by law. All subsequent written or oral forward-looking statements attributable to the Company or any person acting on its behalf are qualified by the cautionary statements herein.