FOR IMMEDIATE RELEASE…Vancouver, BC – January 17, 2024 – Gelum Resources Ltd., (the "Company" or "Gelum", CSE: GMR, OTCQB: GMRCF), through its option agreement with Wealth Minerals Ltd. (“Wealth”, or the “Optionee”, CSE: WML), has received assay results for six diamond-drill holes (1340 metres) completed in October at the Eldorado Gold Project (see news release dated October 16, 2023). Breccia and veins comprising chalcedonic silica (indicative of a high-level epithermal gold environment) with iron-carbonate and sulphides were intersected in all holes. The best intersection assayed 0.412 g/t gold over 95.8 metres (ELD23-03 from 101.65 to 197.5 m), which includes two higher-grade intervals of 5.78 g/t Au over 1.70 meters and 5.66 g/t Au over 0.55 meters. A narrow arsenopyrite vein near the top of the hole (at 6m) contains visible gold and assayed 12.84 g/t Au over 0.5 meters. Both intercepts are open in all directions.

The programme is the second-phase of drilling on the property by Gelum; the first was completed in September 2022 (see news releases dated March 6, 2023 and November 1, 2022). Gelum also completed a 3D pole-dipole DCIP survey over approximately 1.5 square kilometres of the main mineralized trend in conjunction with the drilling (see news release dated November 28, 2023). Gold grades at Eldorado correlate strongly with arsenopyrite concentration, followed by stibnite, galena, and sphalerite.

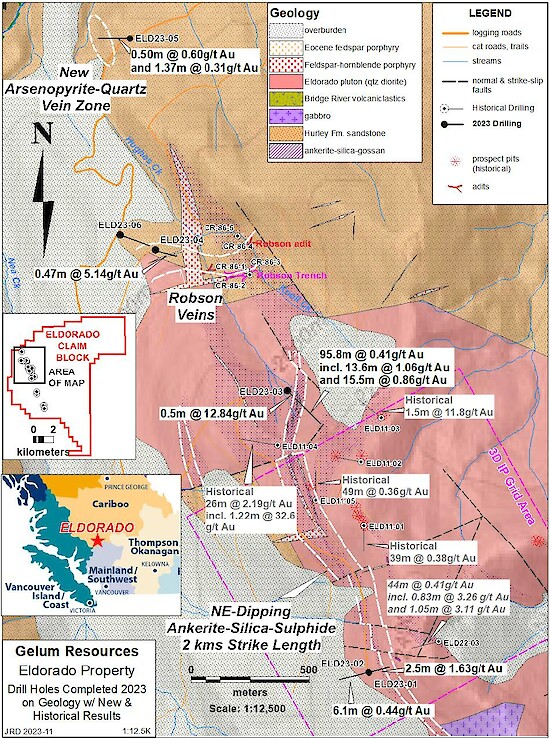

The Eldorado Gold Property is located 22 kilometres north of the Bralorne mine, and 17 kilometres north of the community of Gold Bridge in the south Cariboo (Figure 1). The 9028-hectare property contains multiple mineral occurrences (BC Minfile listings) including two past-producing, small-scale gold mines (1930s & 40s) at the northern extent of the Bridge River-Bralorne/Pioneer orogenic gold district. Gold occurs in polymetallic sulphide veins, vein-stockwork and breccia within broad envelopes of quartz-carbonate alteration in the Eldorado granodiorite stock and surrounding host rocks. These units are cut by fault arrays associated with regional-scale structures linked to gold mineralization. For detailed maps and project photos, please view and download our presentation on our website.

Summary of Results

Six drill holes were completed across three target areas (Figure 1). All sampled intervals are tabulated in Table 1 (below); missing intervals had no visible alteration or mineralization and were not sampled. True widths, where known, are shown in the sections or described below. Figure 1 includes highlighted intervals from each hole.

Figure 1: Location and geology of the recent drill holes, with historical holes for context.

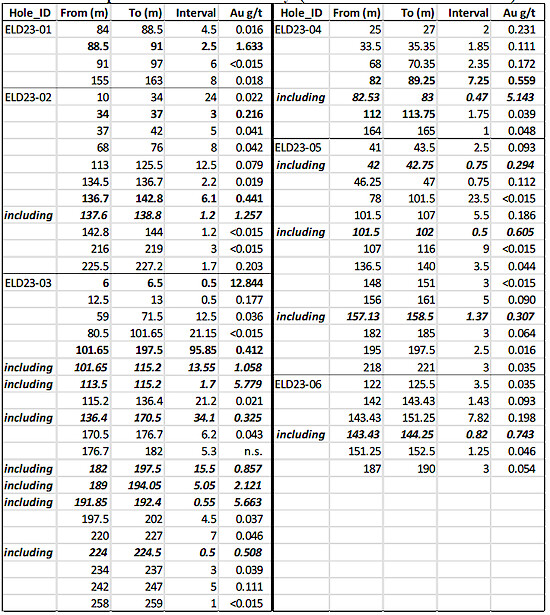

Table 1. Sampled Intervals with Gold Assays (see hole summaries for true widths).

Results and Interpretation

Holes ELD23-01 (182 metres depth) and ELD23-02 (263 m) were drilled in opposite directions from the same drill pad. ELD23-01 was designed to test the potential of an interpreted subvertical “feeder” for the east-dipping breccias, and ELD23-02 targeted additional northeast-dipping, sulphide-bearing, siliceous ankerite vein/breccia panels structurally below an approximately 80-metre thick panel intersected in hole ELD22-03 drilled in 2022 (see news release dated March 6, 2023). The extension of this horizon is exposed at surface and consists of gossanous ankerite alteration with anomalous gold along the ridge col east of Nea Peak, over 800 metres south of ELD22-03, and has a total potential strike length of 1300 metres. Both holes were collared just below the main panel of ankerite-silica-sulphide, in unaltered quartz diorite, and intersected several additional mineralized subvertical and/or east-dipping veins and breccias across their lengths (see Figure 2 for significant intercepts). True widths are estimated to be 35 - 90% of the interval.

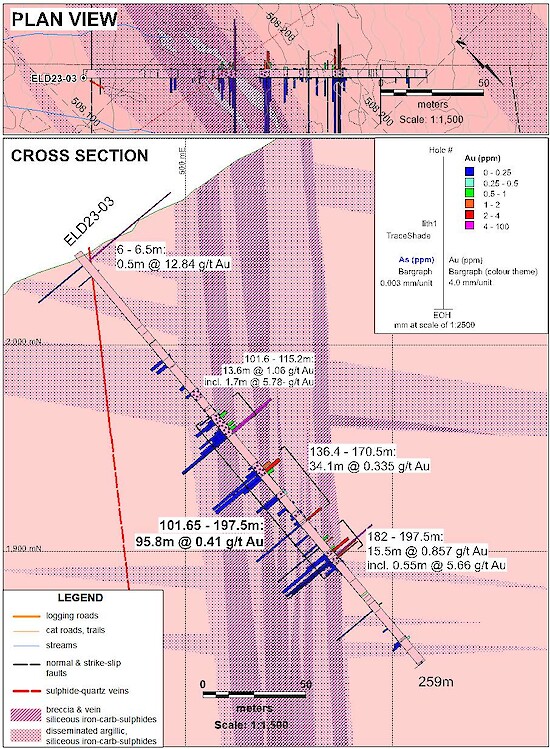

The third drill hole, ELD23-03, targeted the north end of the main NNW-trending breccia, which crops out as a highly gossanous structure near the top of the Robson basin, the centre of historical placer-gold ground sluicing (Figures 1 and 2; Table 1). At approximately six metres depth, the hole intersected a 4-centimetre veinlet of massive arsenopyrite-stibnite-galena with visible gold grains (both on outer core and on cut surface) at about 20o to the core. A 0.5 m sample returned 12.84 g/t Au (0.2m true width). The vein is hosted in relatively weak iron-carbonate alteration subparallel to the main broad zone of iron-carbonate breccia and veins.

The main structure contains numerous semi-continuous sulphide-bearing breccia and vein breccias, that range from 20o to 80o to the core axis, with the strongest mineralization from approximately 86 – 205 metres down-hole (Photo 2). Within this interval, from 101.65 to 197.5 m returned 95.8 metres at 0.412 g/t Au, including two higher-grade intervals of 5.78 g/t Au over 1.70 meters and 5.66 g/t Au over 0.55 meters that have more abundant arsenopyrite. The hole ended at 258 metres where it intersected one metre of iron-carbonate alteration without significant gold mineralization.

Photo 1: ELD23-03 between 104.5 – 116.5m, showing typical sulphide-silica breccia.

Figure 2: Cross section and plan for ELD23-03.

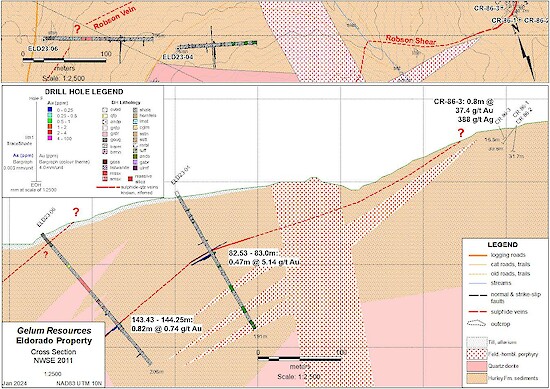

The fourth drill hole, ELD23-04 (188 m), targeted the western extension of the east-west trending, shallowly north-dipping Robson polymetallic vein (with minor historical gold and base metal production) and the subparallel, and higher grade, Robson shear. The collar location was centered on a VTEM anomaly located 400 metres west of the historical workings where Maxwell plate modeling produced a thin conductor that closely matches the Robson shear orientation. The Robson vein and shear zone were previously tested in 1986 by five short holes. Hole CR86-3 intersected 0.8 metres of 37.4 g/t gold and 388 g/t silver at 7.6 metres down-hole on the Robson shear. Channel sampling of the trench in 2006 by one of the property owners returned 1.0 metre of 48.7 g/t gold and >200 g/t silver.

ELD23-04 intersected a polymetallic sulphide-quartz vein (9 cm true width) mineralogically identical to the Robson shear zone, at 82.7 metres down hole (Photo 2). A 0.47-metre sample across the vein and alteration halo returned 5.143 g/t Au and 89 g/t Ag. Hole ELD23-06 was collared northwest and below ELD23-04 and was designed to intersect this sulphide vein approximately 150 m down-dip. At a depth of 143.4 m, a 1 cm arsenopyrite vein was intersected at 75o to core and aligns with the downdip extension of the vein; a 0.82 m sample returned 0.743 g/t Au.

Neither drill hole appeared to intersect the Robson vein, though a 2 m interval between 25 – 27 m that returned 0.231 g/t Au may be the distal expression of the vein. The Robson vein is described as having a very shallow dip (parallel to slope) and may not strike into the area of these two holes.

Photo 2: ELD23-04 at 82.7 m: stibnite-galena-sphalerite-arsenopyrite vein with quartz envelope; a 0.47 m sample across this returned 5.14 g/t Au, 89 g/t Ag.

Figure 3: Cross section and plan for ELD23-04 and 06; note the historical Robson showing holes are off-section.

Hole ELD23-05 (239 m), targeted a series of moderately southeast to northeast-dipping arsenopyrite-silver veins in intensely silicified siltstone/sandstone exposed in a newly discovered outcrop below the main logging road, along Hughes Creek. The new showing is one kilometre below the Robson showing and on strike with the regional north-northwest mineralized trend (see Figure 1). At least three arsenopyrite veins from 1 to 10 cm thick are exposed for several metres along strike. Chip samples returned 1.75 g/t Au over 0.40m and 2.25 g/t Au over 0.2m. These veins, and an additional eastern vein, were intersected by ELD23-05 at the projected depths. Three separate intervals ran 0.75 m at 0.294, 0.5 m at 0.605, and 1.37 m at 0.307 g/t Au (true widths estimated at 70-90%). The strong alteration suggests more mineralization could occur beneath the thick till cover to the east, on the main mineralized trend, and geophysics is warranted to develop additional drill targets.

Readers are cautioned that historical drilling and surface sampling results reported here should be viewed primarily as a guidance for future exploration drilling. Surface sampling is prone to sampling bias and is not necessarily a reliable indicator of mineralization at depth. The qualified person for this release has not done sufficient work to independently verify the historical sampling results described above.

Drilling Logistics, Sampling Procedures and QAQC

Gelum engaged Quesnel Bros. Diamond Drilling (“QB’) in September 2023 to continue drilling the 3000-metre programme started in September 2022. A total of 1340.0 metres were drilled in six holes from five widely spaced platforms (see Figure 1). As the drilling started late in the season (end of September), QB mobilized two rigs: 1) a lightweight Hydracore 2000 drill rig, supported with helicopter service by Eclipse Helicopters of Penticton, B.C., utilizing the nearby Gun Lake strip for logistics, and 2) a skid-mounted rig, which was trucked and pulled to site via the north logging road access and new drill trails to the ridge crest.

All core was NQ size, and the average recovery was 87%. Only hole ELD23-06 had any significant recovery issues, as it collared in apparent fault gouge. A Reflex ACTIII Core Orientation ToolTM was used for downhole surveying every 40 metres. Hole coordinates were collected using a handheld GPS after the drill rig was removed.

Gelum contracted Hardline Exploration Corp. of Smithers, B.C. (“Hardline”), for all drill monitoring, core logging and sampling. Core was transported from the drill pad by helicopter to the airstrip at Gun Lake, then by truck to a logging, splitting, and sampling facility in Gold Bridge. Hardline geologists logged and tagged the core for sampling, which was then photographed before being cut in half with a diamond saw. One half was collected for sample preparation and analysis, and the other retained for future reference. Photographs were taken again before the boxes were stacked adjacent to the shack for storage.

Samples were collected on maximum two-metre sample intervals where mineralization was diffuse, and at a minimum of 0.41 metres where mineralization was well-defined. Samples were rigorously marked, cut, and bagged using security seals, then shipped to MSA Laboratories in Prince George, B.C. (“MSA”) for preparation for gold by Chrysos PhotonAssayTM at that facility, and multi-element ICP at their Langley, B.C. facility. A total of 271 core samples and an additional 24 quality control samples were submitted in October, with four additional samples added in November to close a gap between intervals in ELD23-03.

At MSA, the entire sample was dried and crushed to 70% passing -2mm and 1 kg is split off (code CRU-220). A ~500g riffle split of -2mm material for gold assay by photon activation using Chrysos PhotonAssayTM (CPA-Au1), The remainder of the coarse crush was pulverized and a 0.25g split used for multi-element analysis using MSA’s ICP-230 package, which includes 4-acid digestion and ICP-AES finish. MSA meets all requirements of International Standards ISO/IEC 17025:2005 and ISO 9001:2015.

Analytical accuracy and precision were monitored by the analysis of field-inserted blanks, certified reference material (“CRM”), pulps for multi-element ICP and coarse crush for PA), and duplicate (coarse reject) samples. Wealth inserted blind CRM pulps of two gold grades, purchased from OREAS North America, at regular intervals (1 in 20) into the sample sequence by field personnel to independently assess analytical accuracy of assays. Empty sample bags were inserted at 1:20 intervals in the sample stream for the lab to fill with coarse crush (-2mm) material, as a duplicate of the previous sample. Blanks comprising commercial landscape rock (crushed bricks) were inserted during the cutting/sampling phase at a ratio 1:40.

In the QA/QC review of gold results, the grades of 11 inserted CRMs closely matched the certified gold grade of the respective CRMs. The duplicates’ gold precision ranged from 0 to 14%, which is acceptable as the grades were all <3X the detection limit. One blank sample from within a non-mineralized interval returned slightly elevated gold (0.024 ppm); all others were below the gold detection limit of 0.015 ppm. All results are considered acceptable and Gelum’s QP has confidence in the data.

Readers are cautioned that descriptions of down-hole mineralization and surface sampling results reported here should be viewed primarily as a guidance for future exploration drilling. There is no certainty that mineralized intersections will have significant metal content. In addition, surface sampling is prone to sampling bias and is not necessarily a reliable indicator of mineralization at depth. The qualified person for this release has not done sufficient work to independently verify the historical sampling results, from either surface or drill core, described herein.

Next Steps: Extending the Geophysical Coverage and Re-evaluating Drill Targets

The 3D IP survey outlined a significant, untested anomaly open to the west, the north, and at depth. The IP data indicates the sulphide content is highest in this east-west root zone, and since gold at Eldorado is hosted by mostly with arsenopyrite, and lesser so with stibnite and galena, the anomaly should also have the highest gold concentration. This is now the priority drill target and several proposed holes on the east flank of the main ridge will be moved to the west to test the IP metal factor anomaly at depths of 300-400 metres. The down-dip and north extension of the main gold-mineralized ankerite structure will also be tested at depth (below the limits of the IP in that area) by holes at the east edge of the Robson basin (Knoll Creek area). The 3D IP survey will be extended 600 m to the southwest to Nea Creek, and one kilometre northwest past the Robson showing.

Qualified Person

John Drobe, P.Geo., a qualified person as defined by NI 43-101, has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Mr. Drobe is not independent of the Company as he is a consultant of the Company.

About Gelum Resources Ltd.

Gelum Resources is a Company led by seasoned management and advisors in the mining and financial sectors. The Company’s objective is to define a multi-million-ounce economic gold deposit on the 9028-hectare Eldorado Gold Project, located within the Bralorne-Bridge River gold district, only 190 kilometres north of Vancouver and 74 km northwest of the town of Lillooet, B.C. The Bralorne mines historically exploited the largest, highest-grade, longest-producing lode-gold deposit in B.C.

Management is proud to have developed an excellent working relationship with the Bridge River Indian Band (Xwísten) the project is within the St’at’imc territory (Traditional Territory) in which Xwísten and its members assert, hold and exercise constitutionally protected Aboriginal Title and Rights (“Indigenous Title and Rights”).

For further information about the Company and its exploration portfolio, please refer to Gelum Resources latest Corporate Presentation.

Follow Gelum Resources online in the links below for additional updates:

On Behalf of the Board of Directors

Hendrik van Alphen, Director

For further information about Gelum, please contact:

Hendrik van Alphen (henk@hvana.com) or Marla Ritchie (marla@gelumresources.com)

Phone: 604 484-1228

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE- Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information:

This presentation contains forward-looking statements and forward-looking information (collectively, “forward- looking statements”) within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding any potential increase in shareholder value through the acquisition of undervalued precious metal deposits for development, joint venture or later disposition, the potential to partner with mine developers to achieve production at any of the Company’s properties (existing or future); the potential for the capital costs associated with any of the Company’s existing or future properties to be low; the potential for the Company to outline resources at any of its existing or future properties, or to be able to increase any such resources in the future; concerning the economic outlook for the mining industry and the Company’s expectations regarding metal prices and production and the appropriate time to acquire precious metal projects, the liquidity and capital resources and planned expenditures by the Company, the anticipated content, commencement, timing and cost of exploration programs, anticipated exploration program results and the anticipated business plans and timing of future activities of the Company, are forward looking statements. Forward-looking statements are based on a number of assumptions which may prove incorrect, including, but not limited to, assumptions about the level and volatility of the price of gold; the timing of the receipt of regulatory and governmental approvals; permits and authorizations necessary to implement and carry on the Company’s planned exploration programs at its properties; future economic and market conditions; the Company’s ability to attract and retain key staff; and the ongoing relations of the Company with its underlying lessors, local communities and applicable regulatory agencies.

Accordingly, the Company cautions that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ, and such differences may be material, from those set out in the forward-looking statements as a result of, among other factors, variations in the nature, quality and quantity of any mineral deposits that may be located, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, material adverse changes in economic and market conditions, changes in the regulatory environment and other government actions, fluctuations in commodity prices and exchange rates, the inability of the Company to raise the necessary capital for its ongoing operations, and business and operational risks normal in the mineral exploration, development and mining industries, as well as the risks and uncertainties disclosed in the Company’s most recent management discussion and analysis filed with various provincial securities commissions in Canada, available at www.sedar.com. The Company undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events except as required by law. All subsequent written or oral forward-looking statements attributable to the Company or any person acting on its behalf are qualified by the cautionary statements herein.